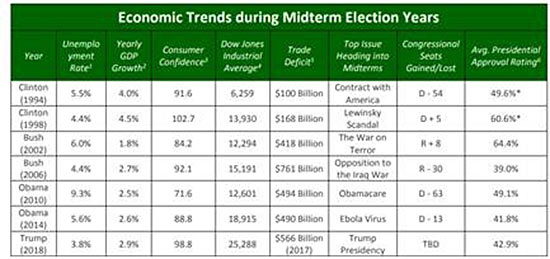

The unemployment rate in May reached its lowest point in the last half century, matching a mark set in April 2000. The previous time the jobless rate ticked this low was all the way back in 1969.

GDP growth almost topped 3 %, reaching its highest point since before the great recession.

Consumer confidence reached a 17 year high in May.

Despite a slight dip early this year, the Dow Jones Industrial Average continues to climb to record levels.

What Trump has done so far

Passed and signed an historic corporate tax cut into law.

Lift tariff of 250+ bn usd Chinese imports, plan to raise the rest (260+ bn usd) next year.

Removed the United States from the costly Paris Agreement.

Revitalizing America’s mining and manufacturing base.

Seeking to lift regulatory burdens on America’s automobile industry.

Kick-started America’s energy sector by curtailing regulations, authorizing the Keystone XL. Pipeline and proposing to open up vast federal areas to oil and gas exploration and production.

Presided over an economic and stock market boom, lowered unemployment and brought 196,000 manufacturing jobs back to America from overseas.

Replaced Obamacare incrementally, beginning with a repeal of the individual mandate.

Removed 25,000 off the federal payroll while pushing for civil service reforms that allows people to be fired for poor performance.

What he has promised if he wins midterm election–> cut personal income tax

The midterm election in Nov 6

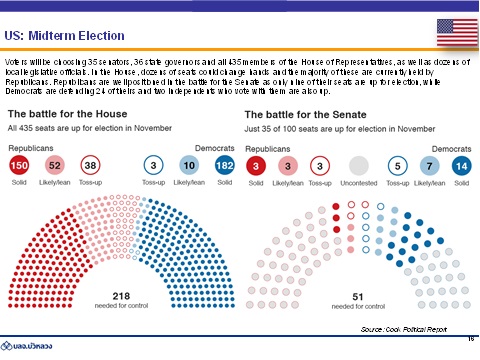

Control of both houses of Congress is at stake.

The Wells Fargo Investment Institute calculated a 50% chance of a divided government, and only a 20% chance that the Democrats retake both houses.

Uncertainty over which party controls each chamber is likely to spur volatility going into the vote.

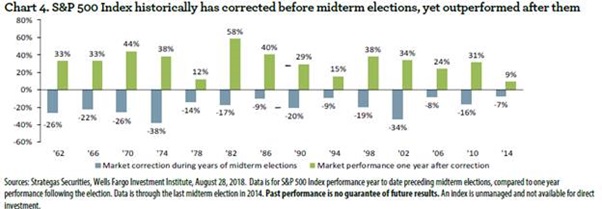

History suggests that investors should expect strong performance afterward, once the uncertainty passes and investors are able to analyze what the new political environment might mean for equities.

According to the Wells Fargo Investment Institute, the S&P 500 sees an average pullback of nearly 19% in midterm-election years, based on data going back to 1962 (or 14 midterm cycles). In the year after the midterm, however, the S&P climbs more than 31%, on average.